Inflation: Cash is Not King, Cash is Trash and Room for Debt Will Grow

We’re currently seeing measurement indicating the highest inflation in a decade. This makes money very cheap but it isn’t all good - the U.S. Treasury will also need to balance rates - on one hand by keeping them low to protect a smooth recovery, while on the other hand, ensuring they raise to accommodate economic improvements. In January of 2021, the U.S. Treasury yield curve has steepened to levels not seen since 2016, signaling that investors expected economic expansion and higher inflation in the coming years as coronavirus vaccines are distributed and President Joe Biden, his administration, and a Democrat-controlled Congress address domestic issues and external roadblocks facing the nation. A mixed geopolitical situation due to U.S. mismanagement could lead to higher volatility in global markets. However, President Biden’s administration is comprised of highly qualified professionals unlike the previous one which was filled with compromised business associates, incompetent friends, and unqualified convicted criminals.

Compared to past episodes of inflation, the current situation might not immediately ring alarm bells. However, the true significance lies in the timing and context in which the spectre of inflation is resurfacing. This resurgence occurs during a period when various asset markets are experiencing record-high valuations, raising concerns about the potential impact of inflation on these interconnected financial landscapes.

While the current inflation rates might not be as daunting as those experienced during previous economic cycles, the underlying factors driving these changes are noteworthy. The current economic landscape is marked by various factors that could potentially exacerbate inflationary pressures. The global economy has been grappling with the aftermath of the COVID-19 pandemic, which led to unprecedented fiscal and monetary stimulus measures in an effort to stabilize economies. These interventions, while necessary, have the potential to introduce new dynamics into the inflation equation.

As the financial markets, including stocks, bonds, real estate, and global debt, continue to operate at historically elevated levels, the introduction of higher inflation rates can introduce a level of unpredictability and risk. Asset prices have been buoyed by low interest rates and ample liquidity, but a sustained increase in inflation could prompt central banks to reconsider their monetary policies, potentially leading to interest rate hikes and a tightening of financial conditions. This scenario could have cascading effects on various asset classes, potentially challenging the stability of the financial system and impacting investor sentiment.

Supply and demand chains are also under serious pressure among construction, import-lead companies, and industries. If the supply of goods falters, as it is doing now, prices will rise, as they are doing now, and central banks will face a terrible dilemma over raising interest rates – as they are doing now. Smelling uncertainty, investors could try to cut and run causing a modest correction in equity prices.

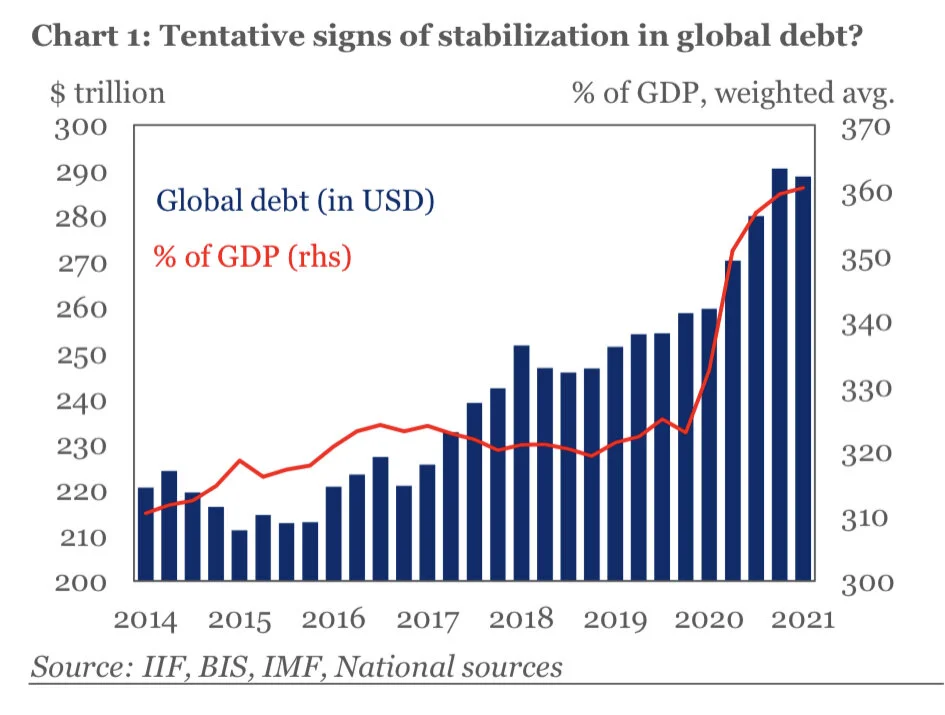

If there is a risk of panic among stock investors, that could be nothing compared to the despair of borrowers for whom even a modest rise in inflation and interest rates could spell pain, even disaster, given the sheer indebtedness of governments, companies and households.

According to a close source to HPG Networks, Mario Veneroso, a Partner and Wealth Manager at Kingsview Asset Management, “In the era of inflation, holders of hard assets, including commodities (whose prices are already pressured by supply-and-demand imbalances), will prosper. As of last month, the Labor Department Reported that the Consumer Price Index rose 5.4% in July from the year earlier. This means household goods whether it’s bread, eggs, or meat, is increasing and consumers haven’t experienced a jump like this in over a decade! It feels like this inflation happened overnight, but within a 12 month period we went from a low inflationary environment to high inflationary environment. From a money management standpoint this has an adverse effect on the time value of your money. So keeping your money in cash instead of hard assets or other tangible investments is theoretically like ‘setting your money on fire.’ Essentially, you are going against the tidal wave of inflation and eroding your purchasing power by sitting on the sidelines with your savings or cash. And I’m not convinced that this inflation is ‘transitory’ in nature as the Federal Reserve is projecting. In my opinion, once a business raises it’s prices and consumers unwillingly adapt to that raise, it’s foolhardy to believe those prices will then go lower in the future. Once prices go up they often don’t come back down in the long run.”

On the other hand, inflation can also be considered a boon for investors CNBC reports that many economists, as well as the Federal Reserve, contend that the rising costs are temporary, and consumers and investors shouldn’t worry much. In fact, given the extreme drops in price for many things in 2020, increasing prices now are more or less getting things back to where they would have been without the pandemic, Mark Zandi, chief economist at Moody’s Analytics, said recently.

Inflation, when managed within reasonable bounds, can actually bring about certain positive outcomes in an economy. One of the benefits of controlled inflation is that it can incentivize spending and discourage excessive hoarding of money. When people expect prices to rise in the future, they are more likely to spend and invest their money rather than keeping it idle. This increased spending can stimulate economic activity, boost demand for goods and services, and ultimately lead to economic growth.

Additionally, moderate inflation can help alleviate the burden of debt for borrowers. As prices rise, the real value of debts decreases over time, making it easier for individuals and businesses to repay their loans. This dynamic can encourage borrowing and investment, which are crucial drivers of economic expansion. Moreover, inflation can offer flexibility to central banks in managing interest rates. By keeping nominal interest rates higher than inflation, central banks can influence real interest rates, which can be beneficial for balancing economic stability and growth.

But families are feeling the effects in their bank accounts each month: Food prices increased an average 3.4% last month compared to July 2020, new cars were up 6.4% and energy costs rose 23.8%. So while certain areas of the market may remain depressed, others will see increases in prices as inflation is not always consistent across industries and sectors.